Institutional Building Blocks for Digital Asset Operations & Systems

Focus on revenue, alpha, and client experience, while streamlining operations front-to-back at a fraction of existing R&D and Finance costs.

Modular & Fast

Revolutionizing digital asset management with secure, cutting-edge solutions tailored for the future of finance. Our platform delivers building blocks for complete support in digital asset management, lending, trading, and payment operations across spot, derivative, and OTC markets. Spanning CeFi, DeFi, and TradFi, Merklebase has processed billions of dollars in volume, empowering users with unmatched precision, intelligence, and efficiency.

Crypto Loan Management System

Seamlessly integrate existing workflows in UI and systems via API, supporting Fiat, BTC, and all crypto instruments, derivatives, SWAPs, and Stablecoins like USDC. Manage and track your or your clients' loan portfolios, margin, and collateral with comprehensive analytics and a robust booking system.

Portfolio & Treasury Management, Trade Capture Booking, Reporting & Accounting

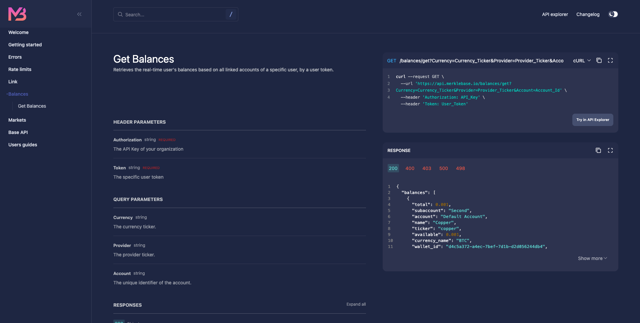

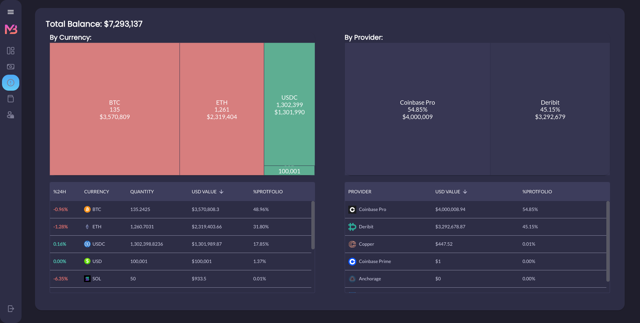

Take control of digital asset portfolios with advanced management tools. User-friendly UI and API support multiple entities, hierarchies, strategies, and L/S position tracking, along with advanced customized reporting across all venues. Manage spot, futures, options, and other derivatives across CeFi and DeFi, with continuous reconciled visibility and forecasting. Integrate third-party data, control worklows, and calculate NAV, ensuring precise oversight and risk mitigation for your digital assets.

Risk Management System

Strengthen digital asset strategy with integrated risk management tools. Designed to navigate the complexities of digital assets, our platform helps identify, assess, and mitigate risks effectively. Access advanced risk metrics such as margin, LTV ratios, exposure, liquidity, VaR, beta, Sharpe ratio, Sortino ratio, drawdown, scenario analysis, and more. All visually presented in UI and available via API.

One Infrastructure, Flexible Building Blocks

Use what is needed. Leverage modular solutions in UI and API to build robust front-to-back operations, focus on trading, transacting, lending, and clients, all with zero infrastructure overhead.

What they said about Merklebase

Read what people have to say about our platform

FAQ

Eliminate Spreadsheets

Try for Free! Revolutionize your workflows!

Company

About

Partners

Resources

F.A.Q

Contact